ดาวน์โหลดแอป

-

- แพลตฟอร์มการเทรด

- แอป PU Prime

- MetaTrader 5

- MetaTrader 4

- PU Copy Trading

- ซื้อขายบนเว็บ

- PU โซเชียล

ดาวน์โหลดแอป

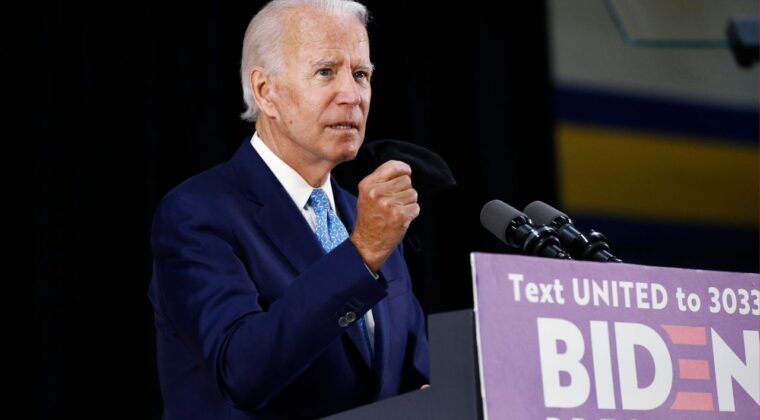

Investor sentiment has taken a hit in the market following the postponement of a meeting between U.S. President Joe Biden and the House Speaker to address the looming debt ceiling crisis. The Biden administration is under pressure to pass the debt ceiling bill by June to avoid a potential default on the country’s bills. Meanwhile, the Federal Reserve’s decision to raise its policy rate to its highest level in 16 years has attracted investors to U.S. money market funds, driving the sector to a new record high of $5.33 trillion and supporting the dollar’s strength. Furthermore, the U.S. has signalled its intention to refill the Strategic Petroleum Reserve (SPR) after June to provide support for oil prices to trade above the $70 mark, despite a pessimistic outlook for the global economy.

Current rate hike bets on 14th June Fed interest rate decision:

Source: CME Fedwatch Tool

0 bps (92.8%) VS 25 bps (7.2%)

The Dollar index, which measures the value of the US Dollar against a basket of major currencies, staged a recovery from a crucial support level in recent trading. This rebound can be attributed to investors engaging in dip-buying of the US Dollar as they reassess their outlook on global monetary policy. However, despite this short-term positive momentum, the latest economic data continues to lean towards a more dovish stance, which may limit the longer-term prospects for the US Dollar.

The Dollar Index is trading higher while currently testing the resistance level. However, MACD has illustrated increasing bearish momentum, while RSI is at 68, suggesting the index might be entering the overbought territory.

Resistance level: 102.15, 103.50

Support level: 100.95, 99.95

Gold prices experienced a decline as investors engaged in profit-taking following the release of crucial data. However, the tensions surrounding the US debt situation provided support for the safe-haven appeal of gold. The ongoing political impasse and the postponement of the debt ceiling meeting between US President Joe Biden and lawmakers have intensified global investor unease. With uncertainty persisting regarding a resolution, concerns of a potential recession loom over market participants, impacting gold prices.

Gold prices are trading lower following the prior breakout below the previous support level. However, MACD has illustrated diminishing bearish momentum, while RSI is at 44, suggesting the commodity might trade higher as technical correction since the RSI rebounded sharply from oversold territory.

Resistance level: 2025.00, 2045.00

Support level: 2000.20, 1975.20

The dollar was strong against most of the major currencies last night, boosted by market risk-off sentiment. The U.S. faces the potential default risk on its bills if the debt ceiling bill is not passed in congress. The meeting between the U.S. president and the house speaker to discuss the issue was postponed, spurring the higher risk-off sentiment in the market. On the other hand, the euro has been sluggish despite the ECB keeping sounds hawkish on its monetary policy and signals that the rate hike will continue if necessary. In addition, the French and Spanish CPI readings will be released later today and investors may refer to the economic data to gauge the price movement of the euro.

The euro has dropped below its price consolidation range and crucial support level at 1.0950. the RSI has been flowing near the oversold zone while the MACD is moving down below the zero line provide a bearish signal for the euro

Resistance level: 1.1126, 1.1225

Support level: 1.0871, 1.0762

On Thursday, the Nasdaq Composite rose by 0.18% to 12,328 points, fueled by optimistic sentiments surrounding a potential rate cut. Spearheading the Nasdaq’s ascent were the shares of Alphabet Inc (GOOGL.O), which surged by an impressive 4.3%. This surge came from Google’s recent introduction of a range of cutting-edge artificial intelligence products, positioning itself to compete with Microsoft Corp (MSFT.O) fiercely. Notably, this development provided investors with renewed confidence in Alphabet’s ability to maintain its stronghold in the tech industry. Additionally, Tesla Inc (TSLA.O) saw a late-trading surge after a tweet from Elon Musk hinted at the discovery of a new chief executive for Twitter. As a result, Tesla shares climbed by 2.1%, further supporting the Nasdaq’s positive momentum.

The Nasdaq Composite index continued its upward trajectory as anticipated, maintaining a steady climb. Furthermore, both technical indicators and market sentiment support this bullish momentum.

Resistance level: 12536, 13151

Support level: 12264, 11961

The British pound experienced a partial recovery but remained weaker against the US dollar on Thursday following the Bank of England’s (BoE) decision to raise interest rates for the 12th consecutive meeting. The central bank’s decision to raise rates by 0.25% to 4.5% brought borrowing costs to their highest level since 2008. However, the BoE adjusted its inflation expectations, now foreseeing a slower decline than anticipated. Encouragingly, the bank revised its growth forecasts upward, signalling a more positive economic outlook. BoE Governor Andrew Bailey emphasized the bank’s commitment to maintaining its current path to bring inflation back to its target. However, he acknowledged that the impact of previous rate hikes may have a greater impact on the economy in the upcoming quarters.

While the pound initially weakened in response to the central bank’s decision, indicating some short-term volatility, experts highlight that the broader outlook for the currency remains positive.

Resistance level: 1.2542, 1.2774

Support level: 1.2371, 1.2194

The Dow Jones Industrial Average fell by 221.82 points, or 0.66%, closing at 33,309.51 on Thursday. Walt Disney Co (DIS.N) dragged down the index as it lost subscribers, while PacWest Bancorp (PACW.O) led declines in regional banks after reporting a 9.5% drop in deposits and increased collateral requirements. Concerns about the health of the regional banking sector resurfaced following recent collapses.

Meanwhile, investors remained on edge due to the ongoing standoff over raising the U.S. debt ceiling. The uncertainty surrounding this issue contributed to increased market volatility. As the deadline for the debt ceiling approached, experts cautioned that further fluctuations and uncertainties could be expected.

Resistance level: 34263, 35486

Support level: 33233, 32626

Oil prices experienced a decline amid a political standoff over the US debt ceiling, which ignited recession fears in the world’s largest oil consumer. Additionally, the oil market was weighed down by rising US jobless claims and discouraging economic data from China. These factors combined to create an atmosphere of uncertainty and exerted downward pressure on oil prices.

Oil prices are trading lower while currently testing the support level. MACD has illustrated increasing bearish momentum, while RSI is at 42, suggesting the commodity might extend its losses after breakout since the RSI stays below the midline.

Resistance level: 74.05, 76.90

Support level: 71.00, 68.95

ซื้อขายฟอเร็กซ์ ดัชนี โลหะ และอื่น ๆอีกมากมายที่ค่าสเปรดต่ำในอุตสาหกรรม และการดำเนินการที่รวดเร็วปานสายฟ้าแลบ

ลงทะเบียนบัญชีจริงของ PU Prime ด้วยกระบวนการที่ปราศจากความยุ่งยากของเรา

โอนเงินเข้าบัญชีของคุณได้อย่างง่ายดายด้วยช่องทางที่หลากหลาย และสกุลเงินที่ยอมรับได้

เข้าถึงตราสารหลายร้อยรายการภายใต้เงื่อนไขการซื้อขายชั้นนำของตลาด

Please note the Website is intended for individuals residing in jurisdictions where accessing the Website is permitted by law.

Please note that PU Prime and its affiliated entities are neither established nor operating in your home jurisdiction.

By clicking the "Acknowledge" button, you confirm that you are entering this website solely based on your initiative and not as a result of any specific marketing outreach. You wish to obtain information from this website which is provided on reverse solicitation in accordance with the laws of your home jurisdiction.

Thank You for Your Acknowledgement!

Ten en cuenta que el sitio web está destinado a personas que residen en jurisdicciones donde el acceso al sitio web está permitido por la ley.

Ten en cuenta que PU Prime y sus entidades afiliadas no están establecidas ni operan en tu jurisdicción de origen.

Al hacer clic en el botón "Aceptar", confirmas que estás ingresando a este sitio web por tu propia iniciativa y no como resultado de ningún esfuerzo de marketing específico. Deseas obtener información de este sitio web que se proporciona mediante solicitud inversa de acuerdo con las leyes de tu jurisdicción de origen.

Thank You for Your Acknowledgement!