ดาวน์โหลดแอป

-

- แพลตฟอร์มการเทรด

- แอป PU Prime

- MetaTrader 5

- MetaTrader 4

- PU Copy Trading

- ซื้อขายบนเว็บ

- PU โซเชียล

ดาวน์โหลดแอป

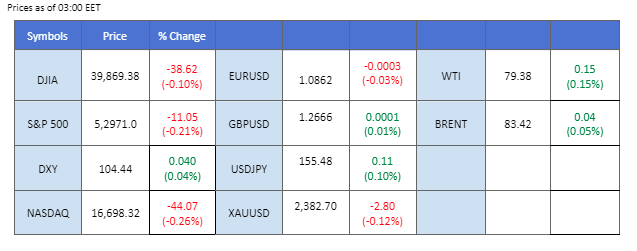

Market Summary

The dollar index (DXY) found support above the $104 mark after two consecutive sessions of decline, as U.S. inflation showed signs of easing. The U.S. initial jobless claims released yesterday came in slightly better than the previous reading, providing some buoyancy for the dollar.

While the U.S. stock market lacked momentum, the Hong Kong stock market rallied, driven by robust earnings from Chinese companies, which fueled upward momentum. In the commodity realm, gold prices remained steady, awaiting a catalyst to pick a direction, while oil prices edged out marginal gains. Lower U.S. crude stockpiles improved the demand and supply outlook for the oil market, and anticipation of a Fed rate cut fueled optimism for oil demand.

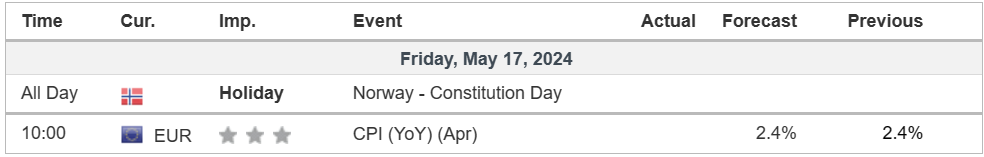

In the forex market, the Japanese yen erased all its gains against the dollar in the last session after the market digested the weaker-than-expected GDP reading. Investors are gauging whether the Bank of Japan (BoJ) might cut bond buying again, which could strengthen the yen. Meanwhile, euro traders are awaiting today’s CPI reading to gauge the euro’s price movement.

Current rate hike bets on 12nd June Fed interest rate decision:

Source: CME Fedwatch Tool

0 bps (97.1%) VS -25 bps (2.9%)

(MT4 System Time)

Source: MQL5

Market Movements

DOLLAR_INDX, H4

The Dollar Index, which trades against a basket of six major currencies, rebounded after a significant dip as Federal Reserve Bank of New York President John Williams adopted a hawkish tone. He noted that while consumer inflation data has slowed significantly, it is not enough for the US central bank to cut interest rates soon. Williams emphasised that monetary policy is “restrictive” and “in a good place,” adding that he does not expect to see sufficient progress towards the 2% inflation goal in the near term.

The Dollar Index is trading higher while currently near the resistance level. MACD has illustrated diminishing bearish momentum, while RSI is at 39, suggesting the index might extend its gains since the RSI rebounded sharply from oversold territory.

Resistance level: 104.70, 105.80

Support level: 103.95 103.15

Gold prices retreated from resistance levels, weighed down by the appreciation of the US Dollar following the hawkish statements from Federal Reserve members. Profit-taking activities in the gold market, coupled with technical analysis signals such as bearish divergence, also contributed to the decline. However, the long-term outlook for gold remains bullish. Economists anticipate the US economy might enter a recession, and global geopolitical uncertainties continue to support gold as a safe-haven asset.

Gold prices are trading lower following the prior retracement from the resistance level. MACD has illustrated increasing bearish momentum, while RSI is at 59, suggesting the commodity might extend its losses since the RSI retreated sharply from overbought territory.

Resistance level: 2395.00, 2430.00

Support level: 2335.00, 2285.00

The GBP/USD pair recorded a technical retracement after rallying by more than 1% since the beginning of the week. The U.S. dollar rebounded from its lacklustre performance, putting pressure on the pair. However, as the market increasingly anticipates a Fed rate cut, downward pressure on the dollar may intensify, potentially fueling further upward momentum for the GBP/USD pair.

GBP/USD faces a technical retracement but is supported at above 1.2650 level. The RSI has dropped out from the overbought zone while the MACD has crossed on the above, suggesting the bullish momentum has eased.

Resistance level: 1.2760, 1.2850

Support level: 1.2600, 1.2540

The EUR/USD pair retraced after the U.S. dollar rebounded following a two-day decline. Better-than-expected U.S. job data provided buoyancy for the dollar, exerting downside pressure on the pair. Meanwhile, euro traders are awaiting today’s Eurozone CPI reading to gauge the direction of the pair.

The pair failed to touch its next resistance level at 1.0900 and retraced. The bullish momentum seems to have eased drastically, with the MACD crossing above while the RSI dropped out from the overbought zone.

Resistance level:1.0865, 1.0940

Support level: 1.0775, 1.0700

The Dow Jones Industrial Average enjoyed a two-day winning streak, breaking above 40,000 for the first time ever as dipping US Treasury yields continued to support the equity market. Walmart Inc. (NYSE: WMT), a major Dow component, jumped 7% after raising its guidance following fiscal Q1 results that beat Wall Street estimates on both the top and bottom lines.

The Dow Jones is trading higher while currently testing the resistance level. MACD has illustrated diminishing bullish momentum, while RSI is at 75, suggesting the index might enter overbought territory.

Resistance level: 39900.00, 40505.00

Support level: 39439.00, 38565.00

The Japanese Yen strengthened against its peers last Wednesday, raising suspicions of Bank of Japan (BoJ) intervention. However, the USD/JPY pair erased all its losses in the previous session, returning to its price consolidation range. Despite these fluctuations, Yen traders are anticipating a potential next round of BoJ intervention, possibly through cutting bond buying, which could bolster the Yen’s strength.

The pair has returned to its previous price consolation range, suggesting fresh bullish momentum may be forming. The RSI has rebounded from near the oversold zone, while the MACD is on the brink of crossing above the zero line, suggesting the bearish momentum has vanished.

Resistance level: 156.90, 158.35

Support level: 154.30, 153.30

The Hang Seng Index (HSI) opened high on Friday, even as momentum in the U.S. equity market eased in the last session. The index has surged to its highest level since last August, climbing toward the crucial psychological resistance level at the 20,000 mark. The Hong Kong market continues to be buoyed by upbeat earnings performances, particularly from tech giants like Alibaba, Tencent, and Baidu.

The Hang Seng index has been trading with extremely strong bullish momentum. It is trading toward its next resistance level at the 20,000 mark. The RSI remains in the overbought zone, while the MACD continues to edge higher, suggesting that the bullish momentum remains strong.

Resistance level: 20650.00, 22240.00

Support level:18200.00, 17210.00

Crude oil prices remained flat, consolidating near support levels as investors struggled to find clear direction in the oil market. On a positive note, the Organization of Petroleum Exporting Countries and Allies (OPEC+) is set to meet on June 1 to evaluate their current oil output cuts. Although further details are unknown, investors should monitor the meeting for trading signals. Additionally, a sharper-than-expected fall in crude oil inventories could benefit oil prices. However, the lack of progress and uncertainties in ceasefire deals have made oil traders cautious.

Oil prices are trading lower following the prior retracement from the resistance level. MACD has illustrated diminishing bullish momentum, while RSI is at 52, suggesting the commodity might consolidate in a range since the RSI stays near the midline.

Resistance level: 79.85, 81.35

Support level: 77.90, 75.95

ซื้อขายฟอเร็กซ์ ดัชนี โลหะ และอื่น ๆอีกมากมายที่ค่าสเปรดต่ำในอุตสาหกรรม และการดำเนินการที่รวดเร็วปานสายฟ้าแลบ

ลงทะเบียนบัญชีจริงของ PU Prime ด้วยกระบวนการที่ปราศจากความยุ่งยากของเรา

โอนเงินเข้าบัญชีของคุณได้อย่างง่ายดายด้วยช่องทางที่หลากหลาย และสกุลเงินที่ยอมรับได้

เข้าถึงตราสารหลายร้อยรายการภายใต้เงื่อนไขการซื้อขายชั้นนำของตลาด

Please note the Website is intended for individuals residing in jurisdictions where accessing the Website is permitted by law.

Please note that PU Prime and its affiliated entities are neither established nor operating in your home jurisdiction.

By clicking the "Acknowledge" button, you confirm that you are entering this website solely based on your initiative and not as a result of any specific marketing outreach. You wish to obtain information from this website which is provided on reverse solicitation in accordance with the laws of your home jurisdiction.

Thank You for Your Acknowledgement!

Ten en cuenta que el sitio web está destinado a personas que residen en jurisdicciones donde el acceso al sitio web está permitido por la ley.

Ten en cuenta que PU Prime y sus entidades afiliadas no están establecidas ni operan en tu jurisdicción de origen.

Al hacer clic en el botón "Aceptar", confirmas que estás ingresando a este sitio web por tu propia iniciativa y no como resultado de ningún esfuerzo de marketing específico. Deseas obtener información de este sitio web que se proporciona mediante solicitud inversa de acuerdo con las leyes de tu jurisdicción de origen.

Thank You for Your Acknowledgement!