ดาวน์โหลดแอป

-

- แพลตฟอร์มการเทรด

- แอป PU Prime

- MetaTrader 5

- MetaTrader 4

- PU Copy Trading

- ซื้อขายบนเว็บ

- PU โซเชียล

ดาวน์โหลดแอป

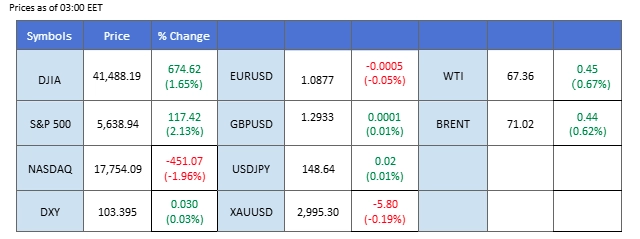

Market Summary

Wall Street staged a technical rebound last Friday, but investor sentiment remains fragile amid uncertainty surrounding Trump’s aggressive trade policies. Market participants are now turning their attention to Wednesday’s FOMC interest rate decision, seeking guidance from Fed Chair Jerome Powell on the central bank’s policy outlook and its potential impact on the U.S. dollar and equity markets.

Despite the brief relief rally, Wall Street futures slipped during the Asian session, reflecting lingering skepticism over the economic outlook. Meanwhile, Chinese markets have outperformed, with the Hang Seng Index and China A50 index climbing higher, as traders diversify away from U.S. equities due to concerns over Trump’s policy stance.

The heightened uncertainty in global markets has propelled gold to an all-time high, breaching the $3,000 mark for the first time in history, reinforcing strong demand for safe-haven assets. In the energy sector, oil prices extended gains after reports that the Trump administration launched its largest military operation to counter Houthi attacks on shipping routes, raising geopolitical risks and fueling supply concerns.

Beyond the FOMC, investors are also closely watching the Bank of Japan’s (BoJ) interest rate decision on Wednesday and the Bank of England’s (BoE) decision on Thursday, both of which could add further volatility to global markets.

Current rate hike bets on 19th March Fed interest rate decision:

Source: CME Fedwatch Tool

0 bps (95%) VS -25 bps (5%)

Market Overview

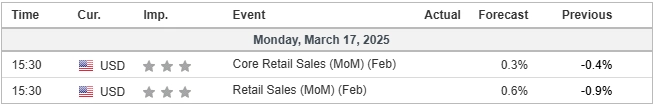

Economic Calendar

(MT4 System Time)

Source: MQL5

Market Movements

The Dollar Index remains under pressure, consolidating in a bearish zone as soft US economic data weighs on sentiment. Weak CPI and PPI reports signal a slowing economy, reinforcing expectations of dovish Fed stance. Prolonged trade tensions and economic uncertainty may keep the dollar on the defensive.

The Dollar Index is trading lower while currently testing the support level. However, MACD has illustrated diminishing bearish momentum, while RSI is at 30, suggesting the index might enter oversold territory.

Resistance level: 105.65, 107.60

Support level: 103.65, 101.70

Gold surged to a record high, briefly testing the $3,005 psychological level, as safe-haven demand increased due to trade war risks and US economic weakness. However, a Russia-Ukraine ceasefire deal and China’s new stimulus plan could limit further upside, as improved global sentiment may reduce demand for gold. Still, ongoing trade fears and a weaker dollar could provide continued support.

Gold prices are trading flat while consolidating in a zone between resistance and support level. MACD has illustrated diminishing bullish momentum, while RSI is at 70, suggesting the commodity might enter overbought territory.

Resistance level: 3005.00, 3055.00

Support level: 2970.00, 2940.00

The GBP/USD pair remains elevated, trading close to the psychological resistance at 1.3000. A decisive break above this level could signal further bullish momentum for the pair. The U.S. dollar remains under pressure, as markets brace for potential retaliation against Trump’s aggressive trade policies, which have raised concerns over a potential global trade war. Meanwhile, the British pound has held firm ahead of Thursday’s Bank of England (BoE) interest rate decision, with expectations that the central bank will keep rates unchanged. With the Fed’s decision coming on Wednesday, followed by the BoE’s policy announcement on Thursday, traders are closely watching for guidance on future rate paths, which could dictate the next move for the pair.

The GBP/USD has been sideways for weeks after the pair performed a significant uptrend since the beginning of January, suggesting a bullish signal for the pair. However, both the RSI and MACD have been sliding in the recent session, suggesting that the bullish momentum has been easing lately.

Resistance level: 1.2955, 1.3050

Support level: 1.2860, 1.2780

The EUR/JPY pair has been trading in a higher-low price pattern, rebounding from its monthly low near the 155.00 mark, suggesting potential bullish momentum. The Japanese yen has weakened as market expectations for Bank of Japan’s monetary policy have shifted toward a more dovish stance. Amid heightened global uncertainties, the BoJ is widely expected to keep interest rates unchanged during its upcoming policy meeting on Wednesday. The EUR/JPY may seize the chance of a weakening Japanese Yen to break its next resistance level at 162.15 mark.

The pair has been trading in a lower-low price pattern and is poised to break above its next resistance level at 162.15. The RSI has been flowing above the 50 level while the MACD is sliding toward the zero line from above, suggesting that the bullish momentum is easing.

Resistance level: 162.15, 164.80

Support level: 159.70, 157.90

The EUR/USD pair continues to trade sideways, fluctuating within a wider range of 1.0955 to 1.0800, as markets await a key catalyst for a breakout. Recent pressure on the euro comes after President Trump announced a 200% tariff on eurozone alcoholic beverages, a move that threatens economic stability in the region. The policy shift has dampened sentiment toward the euro, causing it to lose strength in recent sessions.

The pair has found support at above its previous low level, suggesting that it remains trading within its uptrend trajectory. The RSI has dropped out from the overbought zone while the MACD has been sliding, suggesting that the bullish momentum is easing.

Resistance level:1.0.955, 1.1075

Support level: 1.0806, 1.0672

The Hang Seng Index remained positive after China’s State Council unveiled a stimulus plan focused on income growth, childcare subsidies, and stock/property market stabilization. However, uncertainty over the stimulus size keeps investors cautious. A stronger-than-expected package could support the yuan, Chinese equities, and global markets, while a weaker one may disappoint expectations.

HK50 is trading higher while currently testing the resistance level. MACD has illustrated diminishing bearish momentum, while RSI is at 58, suggesting the index might extend its gains after breakout since the RSI stays above the midline.

Resistance level: 24720.00, 25560.00

Support level: 23360.00, 22545.00

Oil prices jumped in Asian trading on Monday, fueled by concerns over trade disruptions after the US vowed continued strikes against Yemen’s Houthis. Sentiment was further lifted by China’s comprehensive stimulus plan, which aims to boost domestic consumption and drive economic growth. The plan includes investments in autonomous driving, smart wearables, and other high-growth sectors, suggesting a potential rise in energy demand, further supporting oil prices.

Crude oil prices are trading higher following the prior rebound from the support level. However, MACD has illustrated diminishing bullish momentum, while RSI is at 53, suggesting the commodity might experience technical correction since the RSI retreated from overbought territory.

Resistance level: 67.70, 68.40

Support level: 66.40, 65.50

ซื้อขายฟอเร็กซ์ ดัชนี โลหะ และอื่น ๆอีกมากมายที่ค่าสเปรดต่ำในอุตสาหกรรม และการดำเนินการที่รวดเร็วปานสายฟ้าแลบ

ลงทะเบียนบัญชีจริงของ PU Prime ด้วยกระบวนการที่ปราศจากความยุ่งยากของเรา

โอนเงินเข้าบัญชีของคุณได้อย่างง่ายดายด้วยช่องทางที่หลากหลาย และสกุลเงินที่ยอมรับได้

เข้าถึงตราสารหลายร้อยรายการภายใต้เงื่อนไขการซื้อขายชั้นนำของตลาด

Please note the Website is intended for individuals residing in jurisdictions where accessing the Website is permitted by law.

Please note that PU Prime and its affiliated entities are neither established nor operating in your home jurisdiction.

By clicking the "Acknowledge" button, you confirm that you are entering this website solely based on your initiative and not as a result of any specific marketing outreach. You wish to obtain information from this website which is provided on reverse solicitation in accordance with the laws of your home jurisdiction.

Thank You for Your Acknowledgement!

Ten en cuenta que el sitio web está destinado a personas que residen en jurisdicciones donde el acceso al sitio web está permitido por la ley.

Ten en cuenta que PU Prime y sus entidades afiliadas no están establecidas ni operan en tu jurisdicción de origen.

Al hacer clic en el botón "Aceptar", confirmas que estás ingresando a este sitio web por tu propia iniciativa y no como resultado de ningún esfuerzo de marketing específico. Deseas obtener información de este sitio web que se proporciona mediante solicitud inversa de acuerdo con las leyes de tu jurisdicción de origen.

Thank You for Your Acknowledgement!