ดาวน์โหลดแอป

-

- แพลตฟอร์มการเทรด

- แอป PU Prime

- MetaTrader 5

- MetaTrader 4

- PU Copy Trading

- ซื้อขายบนเว็บ

- PU โซเชียล

ดาวน์โหลดแอป

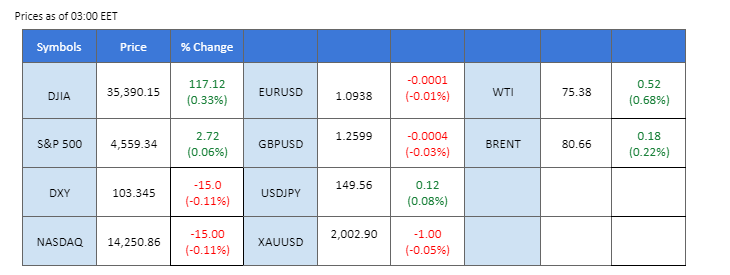

The U.S. equity market is set to return to normal trading hours after the Thanksgiving holiday; meanwhile, with the VIX index reaching its lowest level since January 2020. This suggests a heightened risk-on sentiment, potentially supporting bullish trends in the equity market while putting continued pressure on the U.S. dollar. In the geopolitical arena, Israel and Hamas have signalled a prolonged cease-fire in Gaza. Traders are closely monitoring this development for its potential impact on oil and gold prices. Gold has surpassed the $2000 mark once again, supported by the weakened U.S. dollar.

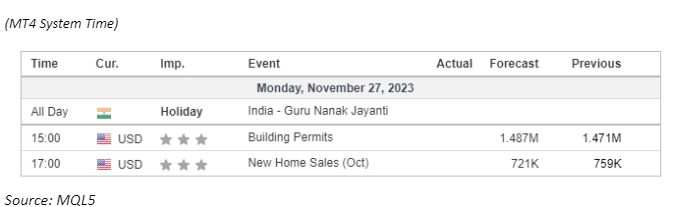

Current rate hike bets on 13rd December Fed interest rate decision:

Source: CME Fedwatch Tool

0 bps (95.0%) VS 25 bps (5%)

The US Dollar extends its losses in light trading sessions, with investors bracing for another potentially gloomy US inflation report. A series of discouraging economic indicators has fueled speculation that the Federal Reserve might consider halting its tightening monetary cycle. Eyes are now on the US Core PCE Index, where expectations loom for a modest rise of 0.10% in November, suggesting potential insights into the Federal Reserve’s future policy decisions.

The Dollar Index is trading lower following the prior retracement from the resistance level. MACD has illustrated increasing bearish momentum, while RSI is at 39, suggesting the index might extend its losses since the RSI stays below the midline.

Resistance level: 104.15, 105.60

Support level: 103.05, 102.15

Gold prices rebound within a consolidative trend, buoyed by the ongoing depreciation of the US Dollar. Investor sentiment leans toward the potential end of the Federal Reserve’s tightening cycle, amplified by a series of lacklustre economic data releases. The focus turns to the US Core PCE Index for further guidance, as market participants seek clarity on the trajectory of the dollar-denominated gold.

Gold prices are trading higher while currently testing the resistance level. MACD has illustrated increasing bullish momentum, while RSI is at 64, suggesting the commodity might extend its gains after breakout since the RSI stays above the midline.

Resistance level: 2005.00, 2025.00

Support level: 1985.00, 1965.00

The sterling maintains its upward trajectory against the dollar, while the U.S. dollar faces ongoing pressure amid heightened risk-on sentiment. Market sentiment leans towards the belief that U.S. interest rates have peaked. In contrast, officials from the Bank of England (BoE) persist in delivering hawkish statements, indicating the British central bank’s determined stance in the ongoing battle against inflation.

GBP/USD is trading in an uptrend trajectory and remains in the uptrend channel, suggesting a bullish bias for the Cable. The RSI is hovering near the overbought zone while the MACD has been above the zero line, suggesting the bullish momentum is still intact.

Resistance level: 1.2710 1.2790

Support level: 1.2502, 1.2390

The Euro gains ground in anticipation of Eurozone inflation data set for release on Thursday. Despite expectations of a slight easing to an annual rate of 2.80%, European Central Bank President Christine Lagarde underscores that borrowing costs will remain restrictive for an extended period. The Euro’s resilience is further underlined by a favourable inflation comparison with the United States.

EUR/USD is trading higher while currently testing the resistance level. MACD has illustrated increasing bullish momentum, while RSI is at 61, suggesting the pair might extend its gains after breakout since the RSI stays above the midline.

Resistance level: 1.0950, 1.1065

Support level: 1.0835, 1.0750

The Australian Dollar (AUD) remains elevated, although the bullish momentum has significantly diminished. Recent U.S. economic data has led the market to anticipate a more dovish stance from the Federal Reserve in its upcoming monetary policy decisions. However, this sentiment has been countered by dovish minutes from the Reserve Bank of Australia (RBA) meeting, suggesting a more lenient approach to monetary policy in addressing inflation concerns. The focus now turns to Australia’s Retail Sales data set to be unveiled on Tuesday, potentially influencing the trend in the AUD/USD currency pair.

The Aussie dollar is currently consolidating after a bullish run. The RSI remains higher while the MACD continues to flow above the zero line, suggesting the pair is still trading with bullish momentum.

Resistance level: 0.6610, 0.6710

Support level: 0.6510, 0.6395

The USD/JPY pair is below a significant liquidity zone near the 149.80 level, signalling a potential trend reversal. The U.S. dollar, considered a safe-haven currency, is experiencing downward pressure amid heightened risk-on sentiment in the market. Market speculation is leaning towards the Bank of Japan (BoJ) potentially pivoting away from negative interest rates shortly, further bolstering the strength of the Japanese Yen. These factors contribute to the evolving dynamics in the USD/JPY pair, with traders closely monitoring the situation for potential shifts in the currency pair’s trend.

The USD/JPY pair has ended its bullish trend below its strong resistance level at near 149.80 level. The RSI is hovering near the 50 level while the MACD has touched the zero line from below and stayed flat, suggesting the bullish momentum has eased.

Resistance level: 150.40, 151.70

Support level: 149.29, 144.39

While oil prices edge lower in a minor technical correction, they mark their first weekly gains in over a month. Attention shifts to the upcoming OPEC+ meeting, initially scheduled for November 26 but delayed to November 30 due to challenges in reaching a consensus on output levels. The meeting gains significance against the backdrop of recent oil price declines, driven by concerns over demand and an influx of supply.

Oil prices are trading lower following the prior retracement from the resistance level. However, MACD has illustrated diminishing bearish momentum, while RSI is at 49, suggesting the commodity might experience technical correction since the RSI rebounded sharply from oversold territory.

Resistance level: 78.30, 80.75

Support level: 74.50, 72.05

ซื้อขายฟอเร็กซ์ ดัชนี โลหะ และอื่น ๆอีกมากมายที่ค่าสเปรดต่ำในอุตสาหกรรม และการดำเนินการที่รวดเร็วปานสายฟ้าแลบ

ลงทะเบียนบัญชีจริงของ PU Prime ด้วยกระบวนการที่ปราศจากความยุ่งยากของเรา

โอนเงินเข้าบัญชีของคุณได้อย่างง่ายดายด้วยช่องทางที่หลากหลาย และสกุลเงินที่ยอมรับได้

เข้าถึงตราสารหลายร้อยรายการภายใต้เงื่อนไขการซื้อขายชั้นนำของตลาด

Please note the Website is intended for individuals residing in jurisdictions where accessing the Website is permitted by law.

Please note that PU Prime and its affiliated entities are neither established nor operating in your home jurisdiction.

By clicking the "Acknowledge" button, you confirm that you are entering this website solely based on your initiative and not as a result of any specific marketing outreach. You wish to obtain information from this website which is provided on reverse solicitation in accordance with the laws of your home jurisdiction.

Thank You for Your Acknowledgement!

Ten en cuenta que el sitio web está destinado a personas que residen en jurisdicciones donde el acceso al sitio web está permitido por la ley.

Ten en cuenta que PU Prime y sus entidades afiliadas no están establecidas ni operan en tu jurisdicción de origen.

Al hacer clic en el botón "Aceptar", confirmas que estás ingresando a este sitio web por tu propia iniciativa y no como resultado de ningún esfuerzo de marketing específico. Deseas obtener información de este sitio web que se proporciona mediante solicitud inversa de acuerdo con las leyes de tu jurisdicción de origen.

Thank You for Your Acknowledgement!